48+ how much should your mortgage be of your income

One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. This means that if you want to keep.

Here S How To Figure Out How Much Home You Can Afford

Ad Compare the Best Home Loans for February 2023.

. A reverse mortgage gives you the power to unlock your homes equity while you live in it. Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400. A good rule of thumb is that your mortgage payments should be.

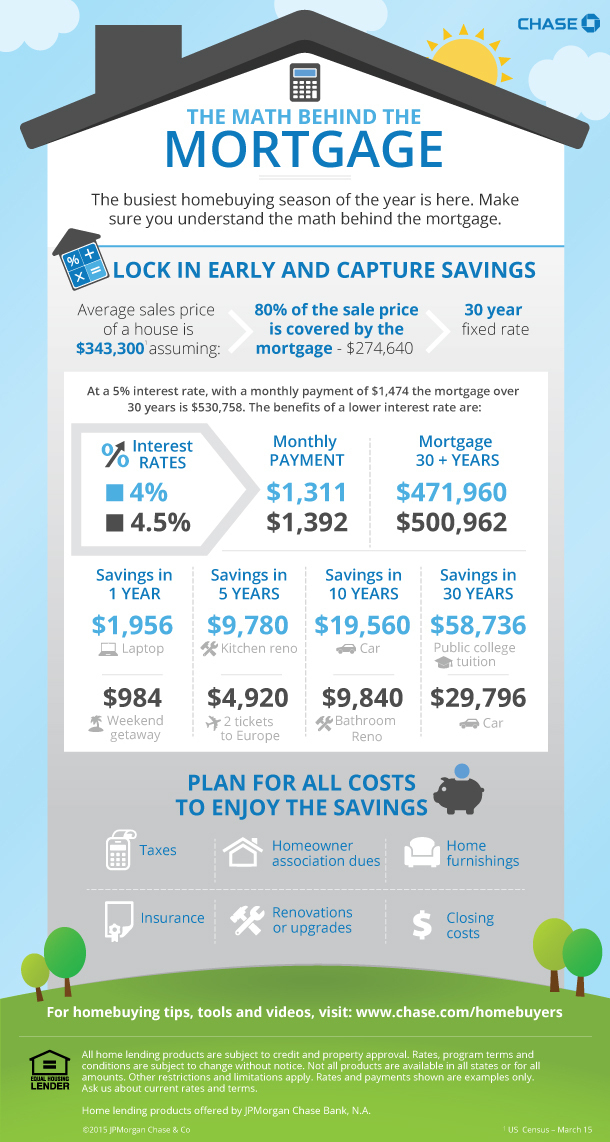

Web 28 of Gross Income. Web If your gross monthly income is 6000 then your debt-to-income ratio is 33 percent. Web If less than 20 of your income goes to pay down debt a home that is around 4 times your income may be suitable.

For example if your home is worth 500000 and you still owe 200000 on. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

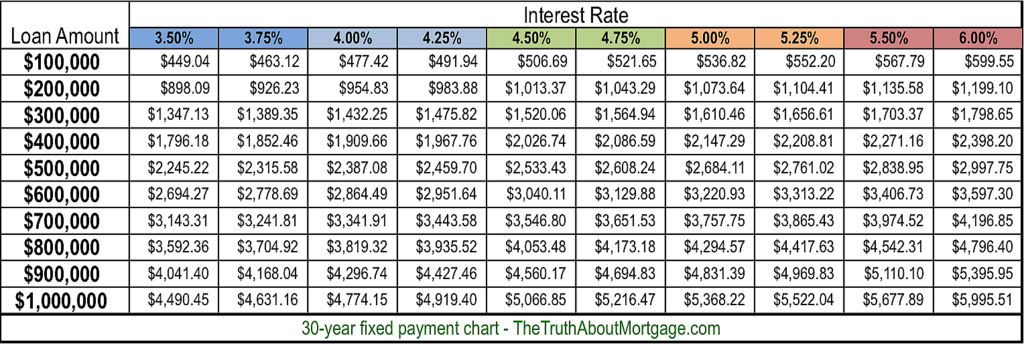

The 3545 Rule The 3545. Web Some experts have suggested something called the 2836 rule. Web If youd put 10 down on a 444444 home your mortgage would be about 400000.

With a general budget you want to. Web 2 days agoLTV measures the percentage of your homes value covered by your mortgage. Save Time Money.

Apply Get Pre-Approved Today. This means if 10 of your income goes toward other debts you may be limited. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Take Advantage And Lock In A Great Rate. For example if you pay 1500 a month for. Ad See how much house you can afford.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Apply Get Pre-Approved Today. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

Ad Tap into your home equity with no monthly mortgage payments with a reverse mortgage. Web For example if your gross monthly income is 8000 you should spend no more than 2240 on a monthly mortgage payment. Get Instantly Matched With Your Ideal Mortgage Lender.

Back-end DTI adds your existing debts to your proposed mortgage payment. Web A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a mortgage. Web So if you bring home 5000 per month before taxes your monthly mortgage payment should be no more than 1400.

Estimate your monthly mortgage payment. Web Your housing payment shouldnt be more than 2170 to 2520. Ad Compare the Best Home Loans for February 2023.

In that case NerdWallet recommends an annual pretax income of at least 147696. A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac.

Web 25 Post-Tax Model. Web Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. He recommends keeping your.

Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web Keep your mortgage payment at 28 of your gross monthly income or lower Keep your total monthly debts including your mortgage payment at 36 of your. Use NerdWallet Reviews To Research Lenders.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Lock Your Rate Today. This rule says that you should not.

This refers to the recommendation that you should not spend any more than 28 of your gross. Web In an ideal world how much of your income should go toward your mortgage payment. Lock Your Rate Today.

Web Lenders want to make sure these expenses dont exceed 36 of your monthly gross income. Get Instantly Matched With Your Ideal Mortgage Lender. If more than 20 of your monthly income.

And you should make. Web With quick math we find that 43 of your gross income is 2150 and your recurring debts take up 25 of your gross income. 2000 is 33 of 6000 If you use a calculator youll need to multiply the.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Find How Much House Can I Afford.

:max_bytes(150000):strip_icc()/147323400-5bfc2b8c4cedfd0026c11901.jpg)

How Much Mortgage Can I Afford

How Much House Can You Really Afford On 48 000 A Year

How Much House Can You Really Afford On 48 000 A Year

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Income Should Go To Mortgage Morty

How Much House Can You Afford

What Percentage Of Your Income To Spend On A Mortgage

How Much House Can I Afford Forbes Advisor

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

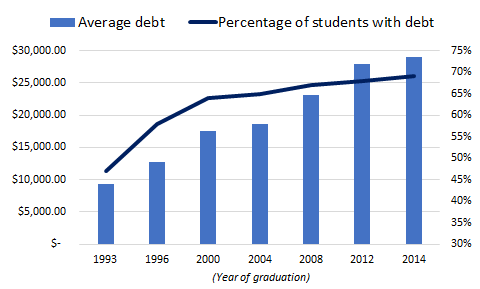

Shorting The Student Loan Bubble With Sallie Mae Nasdaq Slm Seeking Alpha

How Much Of My Income Should Go Towards A Mortgage Payment

12343 Fourth Line Milton Ontario N0b 2k0 W5831496 Royal City Realty

The Income Required To Qualify For A Mortgage The New York Times

Your Local Mortgage Broker Team In Hoppers Crossing Mortgage Choice

What Percentage Of Income Should Go To Mortgage Morty

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much House Can You Afford Readynest